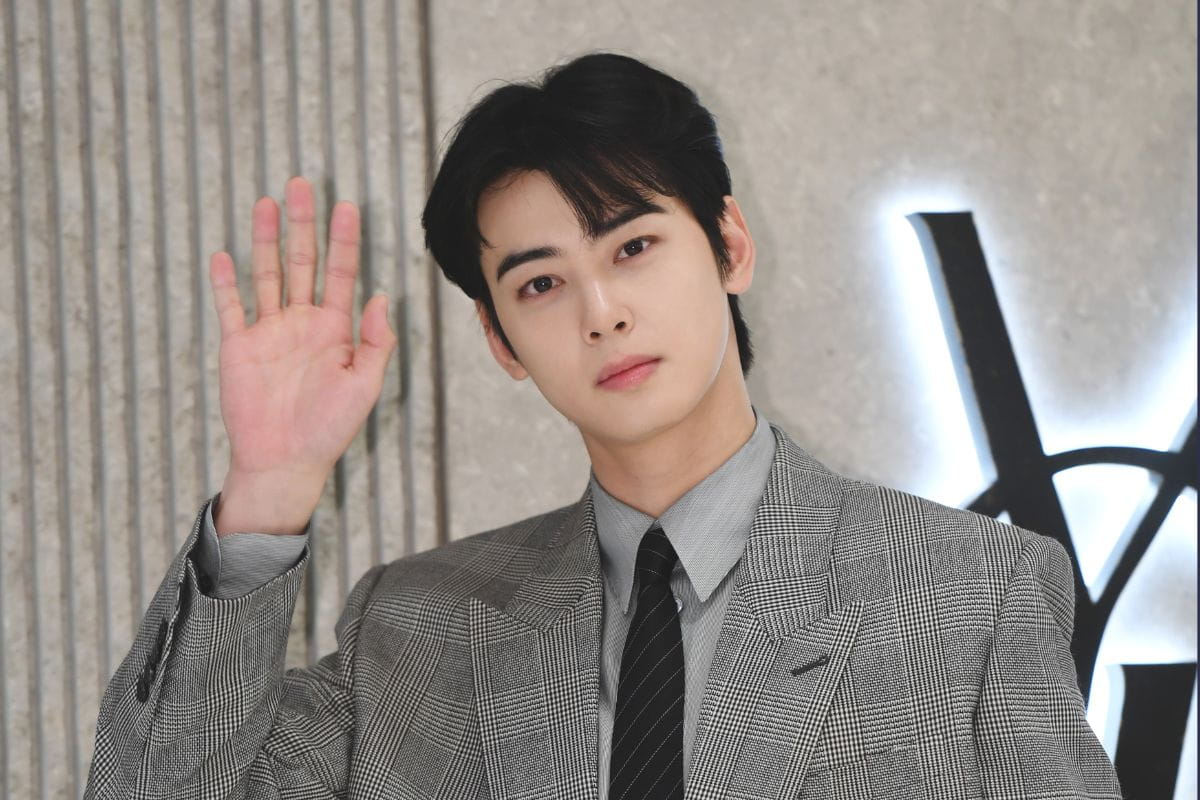

The Korean entertainment industry has been rocked by one of the most unprecedented tax investigations ever involving a celebrity. ASTRO’s member, Cha Eunwoo, became the talk of the town for all the wrong reasons after he faced allegations of large-scale tax evasion.

On January 25, the Seoul Regional Tax Office made a shocking revelation, stating it had conducted an intensive audit into Cha Eun Woo’s earnings during the first half of 2025. Ultimately, the idol evaded approximately $15 million in taxes, which authorities allege that the idol and his mother established a so-called “paper company” to divert a portion of his personal income into a corporate structure taxed at significantly lower rates.

In addition, the National Tax Service reportedly concluded that the entity lacked substantive business operations and functioned solely as a conduit for income shifting. Moon Bo Ra, a former National Tax Service investigator turned tax accountant, described the case as “unprecedented.”

Moon Bo Ra emphasized that the proposed tax assessment would be the largest ever imposed on a single entertainer in South Korea. Cha Eunwoo might also be facing 5 years of prison if the judgment doesn’t rule in favor of his favor. The case has sparked renewed scrutiny of celebrity income structures and tax planning practices across the entertainment industry.